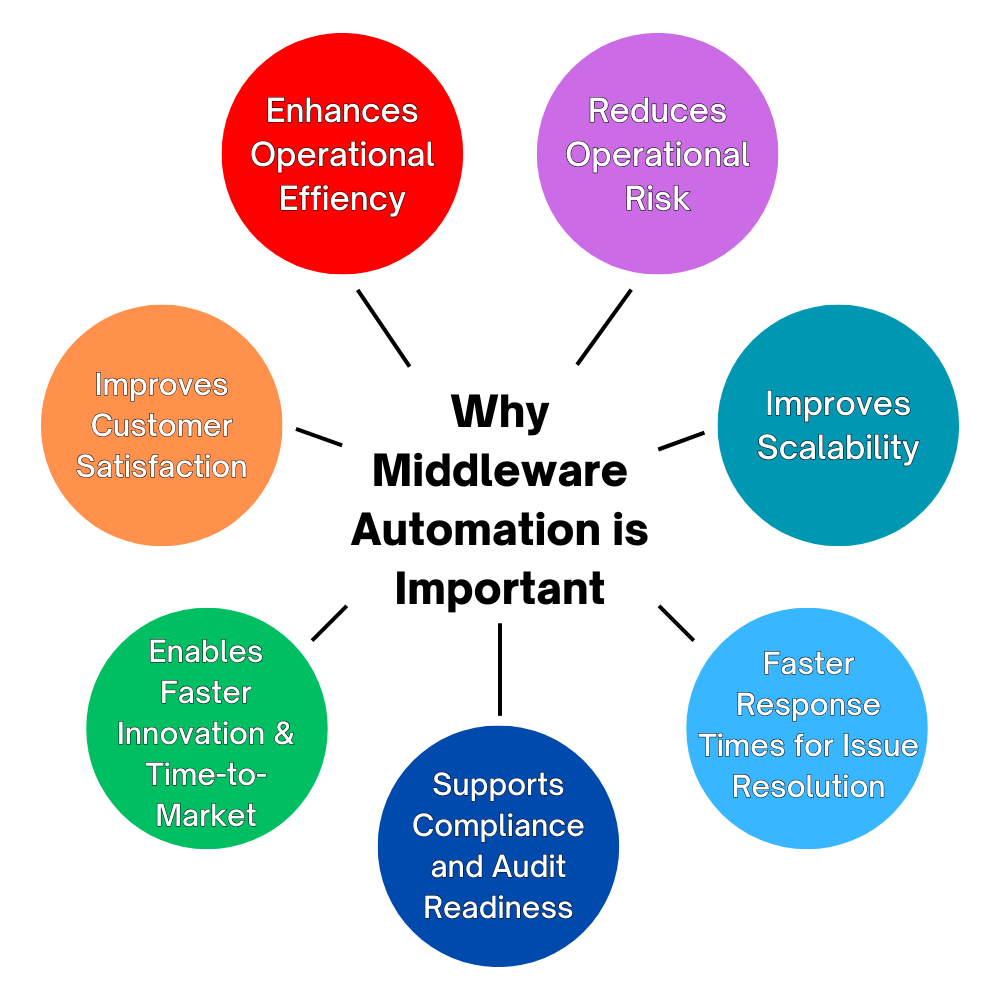

Why Middleware Automation is Important

As banks and financial services institutions face growing demands for efficiency and resilience, IT automation has continued to grow across the industry. A study by SMA showed that 61% of financial institutions are planning to spend more on automation over the next 12 months than they did last year. Middleware automation is an often-overlooked component in IT automation initiatives but there are significant areas you can automate that can have your IT Administrators save time and effort. Middleware is the technology backbone that connects various applications and systems, ensuring seamless operations in IT environments. Automating tasks such as system monitoring, transaction processing, and issue resolution reduces manual errors, enhances performance, and frees up IT teams to focus on innovation. This post explores why middleware automation is not only beneficial but essential for maintaining a competitive edge, ensuring compliance, and enhancing customer experiences in the financial sector.

Automation, specifically middleware automation, has a certain resistance to it and there are several good reasons to theorize why. Automation is always talked about in net-positive ways. Consistent on-time output, fewer costly errors, as well as growth and scalability are excellent reasons why you should consider it. What you may not be considering is the loss of flexibility, the need for reskilling & training, and shifts in employee roles. The last point is crucial for any administrator considering a middleware automation approach. Your employees are the ones whose jobs are being affected by these changes. With all that being said, let’s look at why it’s still important to not to forget about middleware automation as part of your overall IT automation strategy.

1. Enhances Operational Efficiency

Middleware automation streamlines routine tasks such as managing message queues and automating failovers. This improves overall efficiency by reducing manual intervention. For example, automated transaction routing (or message transfer) in a bank ensures faster and error-free processing of thousands of financial transactions, minimizing delays and human errors.

2. Reduces Operational Risk

Financial institutions deal with sensitive customer data and are prone to compliance risks. Automating certain tasks in middleware systems can enforce security policies, ensure data encryption, and perform audits more reliably than manual processes. For instance, an automated system, with proper monitoring and alerting set up, can immediately flag suspicious activity across financial accounts (or even pause certain message flows, moving messages to a holding queue), ensuring timely intervention and compliance with regulations like GDPR or PCI DSS.

3. Improves Scalability

Financial services organizations often face fluctuating transaction volumes, especially during peak times like quarterly results or tax season. Middleware automation allows banks to scale their operations seamlessly by dynamically managing workloads. For example, a financial institution’s automated middleware can distribute increased transaction loads during a surge in demand without requiring additional staff or manual effort.

4. Faster Response Times for Issue Resolution

Automated systems can detect, diagnose, and resolve issues like system outages or application bottlenecks much faster than manual processes. In financial services, where every second counts, middleware automation can quickly restart channels, topics, or queues under specific preset criteria or reroute transactions by automatically moving messages from a problematic queue without waiting for human intervention. This minimizes downtime and ensures uninterrupted service, which is crucial for activities like stock trading or real-time payments.

5. Supports Compliance and Audit Readiness

Financial institutions face strict regulatory oversight and frequent audits. Middleware automation helps maintain accurate logs of all transactions, system changes, and security updates, which is vital for demonstrating compliance. For instance, automation can generate audit trails for all customer transactions, ensuring that banks can quickly provide necessary information during regulatory reviews or incident investigation.

6. Enables Faster Innovation and Time-to-Market

Middleware automation reduces the time IT teams spend on routine tasks, allowing them to focus on strategic initiatives like developing new financial products or enhancing customer experiences. For example, a powerful middleware automation solution will provide automated scenarios for synthetic message testing allowing businesses to simulate real-world messaging scenarios without impacting live systems. This capability helps organizations rapidly identify potential issues in message flows, validate configurations, and ensure system reliability before pushing new features to production. By automating backend processes like this, a financial firm can accelerate the deployment of things like new mobile banking features or integrate with fintech applications, giving them a competitive edge in the market.

7. Improves Customer Satisfaction

Middleware automation ensures consistent and reliable service availability, which is crucial for customer trust in financial institutions. Automated systems that can handle tasks like loan application processing or fraud detection in real-time help banks offer faster, more responsive services to customers. For example, customers of an automated bank might receive real-time fraud alerts, reducing the risk of unauthorized transactions.

These reasons demonstrate that middleware automation is not just a cost-saving measure but a critical strategy for improving competitiveness, security, and customer satisfaction in the financial services industry.

Practical Implementation

Infrared360® has been helping banks and financial services organizations with their middleware automation for over 15 years. Middleware automation of technologies like MQ, IIB/ACE, Kafka & more provides immense time savings for administrators and other team members. By automating routine middleware management processes, Infrared360 can streamline operations, reduce errors, and increase overall efficiency. Here are a few ways it can be done:

Message Transfer

One middleware automation process Infrared360 customers often use is message transfer. At banks and financial services organizations, this is particularly beneficial for systems administrators, support teams, and operations staff, who manage message flows and ensure system reliability. Here’s how Infrared360 can streamline this process:

- Set Up an Alert: Create an alert that triggers when a message meets specific criteria, such as being older than two hours. (note that Infrared360 has powerful alert parameter definition capabilities that allow you to create “stacked” that combine several and/or conditions across multiple objects).

- Define Actions for the Alert: Configure the alert to perform multiple actions. For instance, one action can be to log the alert and send an email notification to the relevant team.

- Automate Message Transfer: Add an action to the alert to automatically move messages from the problematic queue. You can choose to:

– Store the messages in a folder.

– Transfer the messages to another queue for later analysis. - Reduce Manual Intervention: By automating these steps, you eliminate the need for manual intervention. Instead of reacting to an alert by manually moving messages, Infrared360 handles it automatically as part of the alert’s response.

- Prevent Queue Blocking: This ensures that the problematic queue is not blocked, allowing the system to continue processing other messages without interruption.

For example, if an alert indicates that the message age exceeds a threshold, Infrared360 can automatically transfer these messages to another location. This allows support teams to review and address the issue offline without disrupting the flow of other messages.

By automating message transfer, Infrared360 helps Systems administrators and support teams to:

- Save Time: Eliminate manual steps and reduce the time spent on routine tasks.

- Improve Efficiency: Ensure critical issues are addressed promptly without impacting other operations.

- Enhance Reliability: Maintain smooth operations by preventing queues from becoming blocked due to unresolved issues.

Channel Status

Automating the start, stop, or restart of channels can be crucial for banks and financial services organizations to maintain the continuous flow of critical financial data and transactions. Automation ensures that channels can be restarted automatically in the event of failures, minimizing downtime and reducing the risk of service disruption. Additionally, it allows for routine tasks like starting or stopping channels during scheduled maintenance to be handled efficiently without manual intervention, freeing up administrators to focus on more strategic initiatives. By automating these processes, financial institutions enhance the reliability, security, and performance of their messaging infrastructure.

To automate channel status using Infrared360, the platform allows administrators to monitor MQ channels in real-time and automate specific actions based on the channel’s status. This includes automatically restarting channels that have gone inactive or become disconnected. Infrared360 enables you to set predefined thresholds and alerts, ensuring immediate action is taken when a channel fails or deviates from expected behavior. An Admin or user, with proper permissions, would follow similar steps as in the above example (except with channels) to set up automated responses. By configuring these automated responses, administrators can ensure consistent uptime without the need for constant manual monitoring, improving operational efficiency.

For more detailed steps, you can refer to our recorded webinar on 4 Things You Can Automate to Save Time & Effort on MQ Administration. While it covers MQ automation, many of the concepts and steps are the same for most middleware.

Reporting

Another middleware automation feature of Infrared360 that our bank and financial customers frequently praise is the automated reporting capability.

Timely delivery of reports on middleware environments and user auditing is crucial for banks and financial institutions to ensure compliance with strict regulatory requirements and maintain security. These reports provide insights into system performance, potential vulnerabilities, and user activities, helping to identify unauthorized access or anomalies quickly. By having access to up-to-date reports, institutions can address issues proactively, reduce operational risk, and ensure uninterrupted service for critical financial transactions.

Infrared360 provides a wide range of reporting capabilities, with the primary advantage being its ability to deliver crucial information to specific users or groups exactly when it’s needed. Reports can be automatically generated based on required data and sent in multiple formats, such as HTML, PDF, CSV, or Excel. Whether daily, weekly, or monthly, these reports can be scheduled for automatic distribution, even to individuals who don’t have Infrared360 access, like management, compliance and security officers, and others. Although manual report generation is available when needed, automating the process allows teams to focus on more strategic tasks, maximizing efficiency.

To combat report fatigue, where individuals or teams become desensitized to an overwhelming number of reports, Infrared360 allows for customized reporting. By tailoring reports to specific recipients who need the information, reports become more valuable and actionable. This automation enhances efficiency in MQ Administration.

Conclusion

In conclusion, middleware automation is no longer a luxury but a necessity for banks and financial services organizations that seek to maintain competitive advantage, enhance operational efficiency, and reduce risk. By automating tasks like channel management, message transfer, and reporting, solutions like Infrared360® not only save time but also help streamline compliance efforts and improve system reliability. With real-time monitoring, automatic error resolution, and customized reporting, Infrared360 empowers IT teams to focus on strategic initiatives rather than routine maintenance tasks.

Want to see how Infrared360 can transform your MQ administration? Sign up for a live demo today to explore its full range of automation capabilities and experience firsthand how it can optimize your middleware environment

More Infrared360® Resources